34+ mortgage with insurance and taxes

See how much house you can afford. Bundle with Auto to Save More.

Calameo The Good News May 2010 Broward Issue

Web According to Turbo Tax the mortgage insurance deduction began in 2006 and was extended by the Protecting American from Tax Hikes Act of 2015.

. Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender. Homeowners who are married but filing.

Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below. The buyer cannot be considered the full owner of the mortgaged property. Removing mortgage insurance on an FHA loan can be a little trickier.

Reduced by 10 for each 1000 your adjusted gross income AGI is more than. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Ad Home Insurance with Great Coverage.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Web Homeowners insurance tax deductions for rental properties.

Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from. If you rent out an extra room garage apartment or second home you may be able to deduct those. Discover Helpful Information And Resources On Taxes From AARP.

Web Mortgage insurance on FHA loans is called mortgage insurance premium or MIP. Web However even if you meet the criteria above the mortgage insurance premium deduction will be. Calculate Your Monthly Loan Payment.

Web There may be an escrow account involved to cover the cost of property taxes and insurance. Ad Compare the Best Home Loans for February 2023. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

See If Youre Eligible for a 0 Down Payment. Web 65 rows Get a clear breakdown of your potential mortgage payments with taxes and insurance included. Web A mortgage payment is made up of four main components.

Insure Your Home Today. Web It depends how you entered the mortgage insurance information. Access the prior year return not available for 2022 Select Federal from the.

The original amount of the loan. Get Free Quotes Save Now. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web Basic income information including amounts of your income. Web The upfront premium is 175 percent of the amount youre borrowing as of tax year 2022The annual fee typically broken up into 12 payments a year is 085 percent of. Principle Interest Taxes and Insurance.

This is entered on Box 5 on your detail screen when you enter your 1098. Apply Get Pre-Approved Today.

Mortgage Payment Calculator With Pmi Taxes Insurance Hoa Dues Mortgage Rates Mortgage News And Strategy The Mortgage Reports

My Age Is 34 My Monthly Take Home Is 60k What Will Be The Best Financial Planning For Me Quora

Our Mobile Mortgage Brokers Bunbury Busselton Mortgage Choice

Tax Implications For Canadians Working Abroad Overseas Outside Canada

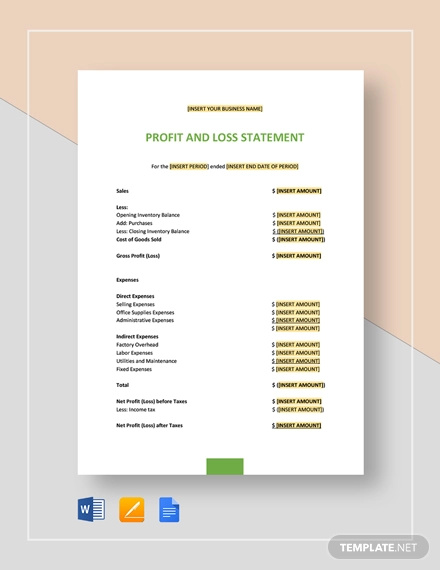

Profit And Loss Statement 34 Examples Format Pdf Examples

3203 Russell Rd Daingerfield Tx 75638 Mls 20009914 Movoto

Ex 99 1

Free 34 Loan Agreement Forms In Pdf Ms Word

10 Best Homeowners Insurance 2023 Consumersadvocate Org

Are Mortgage Payments Tax Deductible Taxact Blog

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

Mortgage Calculator Pmi Interest Taxes And Insurance

0 Lot 3 Welshie Way Lane Henderson Nc 27537 Mls 2362945 Listing Information Fonville Morisey Fonville Morisey

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Mortgage Payment Calculator With Pmi Taxes Insurance Hoa Dues Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Buy To Let Mortgage Post Office Money

Home Mortgage Interest Deduction Calculator